Table of Content

▼Made-in-India cars are gaining greater global acceptance as major automakers boost exports to make the most of the country's strong cost and talent advantage.

Toyota, Volkswagen, Hyundai, Mahindra, Tata Motors, Honda, and Skoda reported a significant increase in exports in 2023, market leader Maruti Suzuki set a new record by exporting 261,700 passenger vehicles, including cars and SUVs, according to display data.

As Indian regulatory standards move towards global standards, Made-in-India vehicles developed and sold need minimal adaptation to export markets, industry officials say. India's low manufacturing costs, balancing labor costs, availability of skilled labor, and sophisticated supplier base provide automakers with a competitive cost advantage, they said.

“With increasingly stringent regulations focusing on safety, emissions, and technological advancement, Made-in-India car automakers are investing in R&D and innovation,” said Piyush Arora, MD & CEO, of Skoda Auto Volkswagen India. Volkswagen exported 40,920 passenger cars in 2023, registering 29% growth, while Skoda's exports rose 431% to 1,530 units.

Speaking at the Bharat Mobility World Expo 2024 on Friday, Commerce and Industry Minister Piyush Goyal asked the automobile industry to increase the share of Made-in-India vehicles being exported to 50% of all passenger cars made in the country by 2030 from the current levels of 14%. India's automobile exports reached 671,384 units in 2023, up 4% from last year, according to Jato Dynamics.

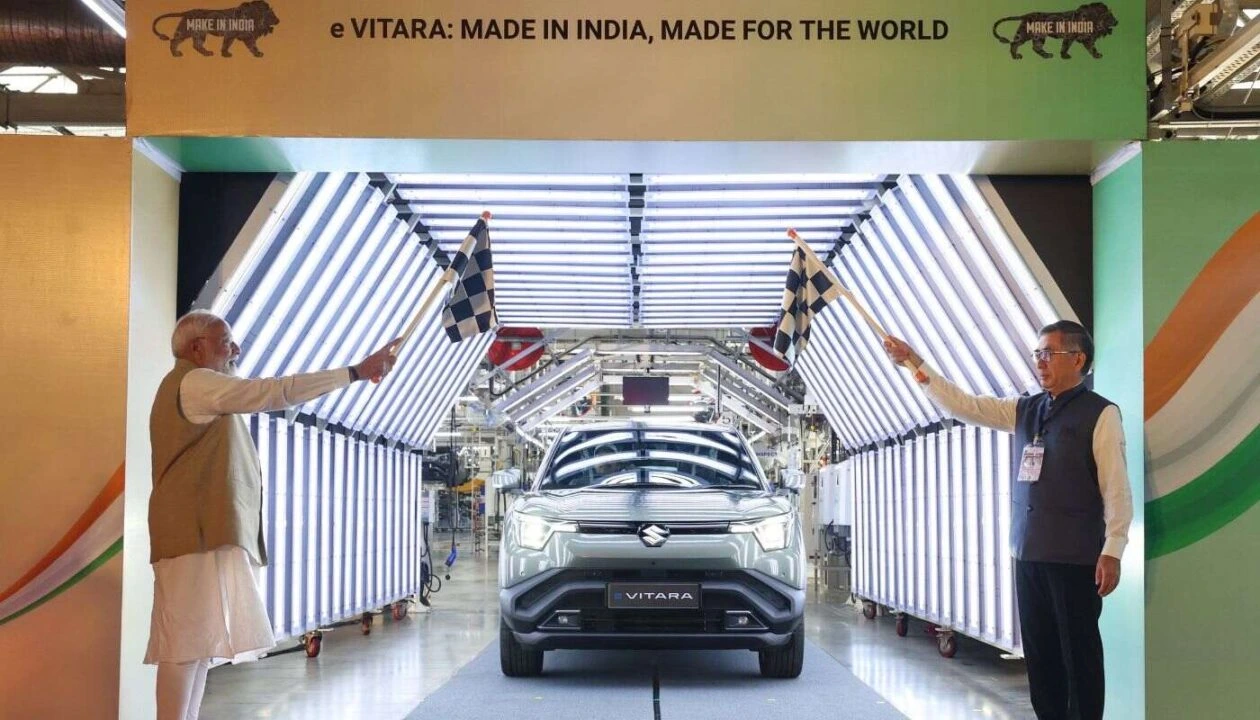

A boost in exports of electric vehicles is also expected, driven by the production-linked incentives program for the automobile and spare parts industry.

Evaluating new markets

Made-in-India Automakers have several electric vehicles scheduled to be launched in the coming years, and will likely ship them to overseas markets as well. Last year, Toyota Kirloskar Motors (TKM) restarted exports by sending the India-made Urban Cruiser Hyryder hybrid SUV to South Africa and West Asia.

"This development demonstrates the company's commitment to 'total electrification', supporting India's emergence as a global manufacturing hub for cleaner, greener vehicles," a company spokesperson said. Toyota exported nearly 16,000 passenger cars in 2023 compared to 263 units the previous year.

The Toyota group also exports electric motors, a crucial component of the electric drive system in vehicles powered by advanced hybrid technology manufactured locally by Toyota Kirloskar Auto Parts (TKAP). Of the total installed capacity of 136,000 units at TKAP, 70% is earmarked for export. In addition to existing export markets, automobile companies are evaluating new regions and markets.

For example, Skoda-Volkswagen plans to ship Indian-made cars to East Asian markets this year. “We will soon export locally manufactured spare parts for Skoda Kushaq and Skoda Slavia for production in Vietnam starting in 2024,” Arora said.

Currently, its main markets include Mexico, GCC, Sub-Saharan countries, and North Africa. In many cases, cars made in India are shipped to other developing markets such as Southeast Asia, Latin America, and Africa. However, most of these markets have their industries and are not very open to imports, said Ravi Bhatia, president of Jato Dynamics.

Tough competition

He added that in the case of more open markets such as Chile, Mexico, and South Africa, competition is very difficult because Chinese manufacturers are stronger and move faster. Last year, China overtook Japan as the largest automobile exporter.

But automakers are keen to boost Made-in-India car exports.

Market leader Maruti Suzuki plans to triple India's exports. In the next 5 to 8 years. “Around 40% of all cars exported from India will be from Maruti Suzuki,” said Shashank Srivastava, senior director of the company.

Its wide model range and size gives Maruti Suzuki a cost advantage for exporting to newer markets, he said. Currently, its five main markets include Chile, South Africa, Saudi Arabia, Ivory Coast and the Philippines. Hyundai, India's second-largest exporter of PV vehicles, is also exploring new markets, said Tarun Garg, chief operating officer, of Hyundai Motor India.

Uncertainty caused by volatile geopolitics and high inflation caused some shipping disruptions last year.

Neha Mehlawat

Neha Mehlawat is an automotive journalist and industry analyst with 10+ years of experience covering cars, bikes, and mobility trends. She tracks the latest launches, technology upgrades, and policy changes in the auto sector, delivering sharp insights that help readers stay ahead in the fast-evolving world of automobiles.

_1756364893.webp)