Table of Content

▼NEW DELHI: India's automotive aftermarket, which was worth $10 billion in 2023, is expected to grow 1.4 times to reach an estimated $14 billion by 2028. ACMA, the apex body for the auto components industry has given this data from its Global Automotive Aftermarket Research Report, which was conducted in collaboration with leading consulting firm Ernst & Young.

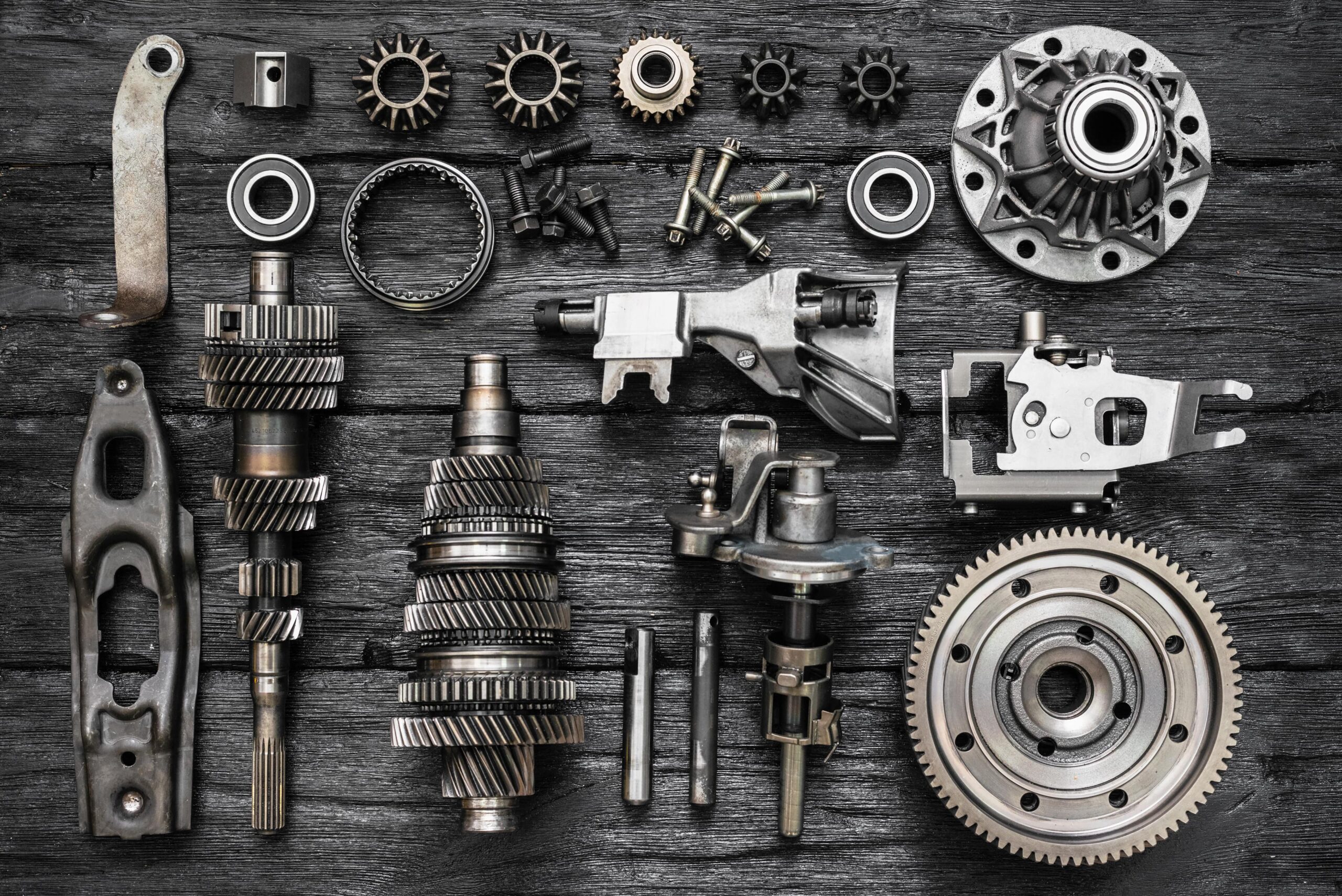

The report, which focuses on seven product categories: engine parts, suspension and brake parts, transmission parts, rubber components, cooling systems, and filters, does not cover tires or consumables such as batteries, coolants, and lubricants.

The insights were unveiled ahead of the 5th ACMA Automechanika exhibition in New Delhi, at the Bharat Mobility Global Expo 2024.

The growth of the automotive aftermarket in India is driven by a steady increase in the vehicle fleet, which currently stands at 340 million and is expected to grow at a CAGR of more than 8% over the next five years. Two-wheeler and passenger vehicle fleets are expected to show strong growth from 257 million to 365 million units and around 47 million to over 72 million units respectively by 2028. Used vehicle sales are expected to grow at 17.5% CAGR till the Fiscal year 2028. The commercial vehicle fleet is expected to grow from 13 million units to 19 million units by 2028. The tractor segment currently contributes nearly $1 billion to the Indian spare parts market, and the fleet is expected to grow from 14 million units to more than 14 million units, the ACMA said in a statement.

Internationally, the study covers 39 countries and focuses on 10 key export markets, identifying more than $35 billion in export opportunities. Five of these markets, namely Indonesia, Latin America, Poland, Brazil, Colombia, and Bangladesh have matured into the aftermarket with a large number of older vehicles, while another five, namely North Africa, South Africa, East Africa, West Africa, and Africa, have matured. The United Arab Emirates is witnessing rapid development and offers high opportunities for growth. The combined export potential of these 10 markets is expected to grow to more than $35 billion by 2028.

Regarding the market potential of the Indian aftermarket industry, Shraddha Suri Marwah, Chairman, ACMA, President and Managing Director, Subros Ltd, said: “Insights from global automotive aftermarket research highlight unique opportunities for market players for automotive parts in India. It will grow the automotive aftermarket which was valued at $10 billion in 2023, 1.4 times in the next five years thanks to growing demand for vehicles and promising capabilities of players. Additionally, ten major international markets provide export opportunities worth more than $35 billion. Indian component suppliers should focus on creating partnerships with international buying groups to access markets, invest in marketing and branding, increase digital presence, and generate collaboration among industry players to deliver their joint offerings to tap global market opportunities.”

“Indian auto component manufacturers witnessed a promising growth of 7.5% in H1FY24 due to higher demand for used vehicles, a preferential shift towards larger vehicles, and increasing formalization of repairs and maintenance market,” said Vinny Mehta, CEO, of ACMA. With the rapidly growing opportunities in the aftermarket, we are pleased to respond to the participation of both local and international players at ACMA Automechanika New Delhi 2024. The event offers automotive component manufacturers from all over the world a platform to network and showcase capabilities in the automotive industry. The exhibition has been seamlessly integrated into the Bharat Mobility World Expo 2024.

The 5th edition of ACMA Automechanika New Delhi from February 1 to 3, 2024, at Bharat Mandapam, Pragati Maidan, New Delhi, will feature over 500 exhibitors from over 12 countries, with pavilions dedicated to countries from Japan, Germany, Korea, Taiwan and Thailand. It will showcase its innovations in aftermarket products, technological advancements, and sustainable mobility solutions.

In addition, nearly 100 other exhibitors will participate in two exclusive automotive components pavilions that will showcase products and solutions for original equipment manufacturers.

Also Read: Opinion: How the Interim Budget 2024 can foster robust automotive landscape

Neha Mehlawat

Neha Mehlawat is an automotive journalist and industry analyst with 10+ years of experience covering cars, bikes, and mobility trends. She tracks the latest launches, technology upgrades, and policy changes in the auto sector, delivering sharp insights that help readers stay ahead in the fast-evolving world of automobiles.

_1772000056.webp)

_1771924453.webp)

_1771917963.webp)