Table of Content

▼- The Big Picture: Green Mobility & Local Tech

- 1. EVs to Get Cheaper (Eventually!)

- 2. CNG Owners, Rejoice!

- 3. Fixing the "Brain" of the Car

- 4. Faster Deliveries via Freight Corridors

- 5. A Human Touch: Relief for Accident Victims

- 6. Boosting the Little Guys (SMEs)

- Budget 2026: At a Glance

- So, What Should You Do?

- Final Thoughts

- Also Read This

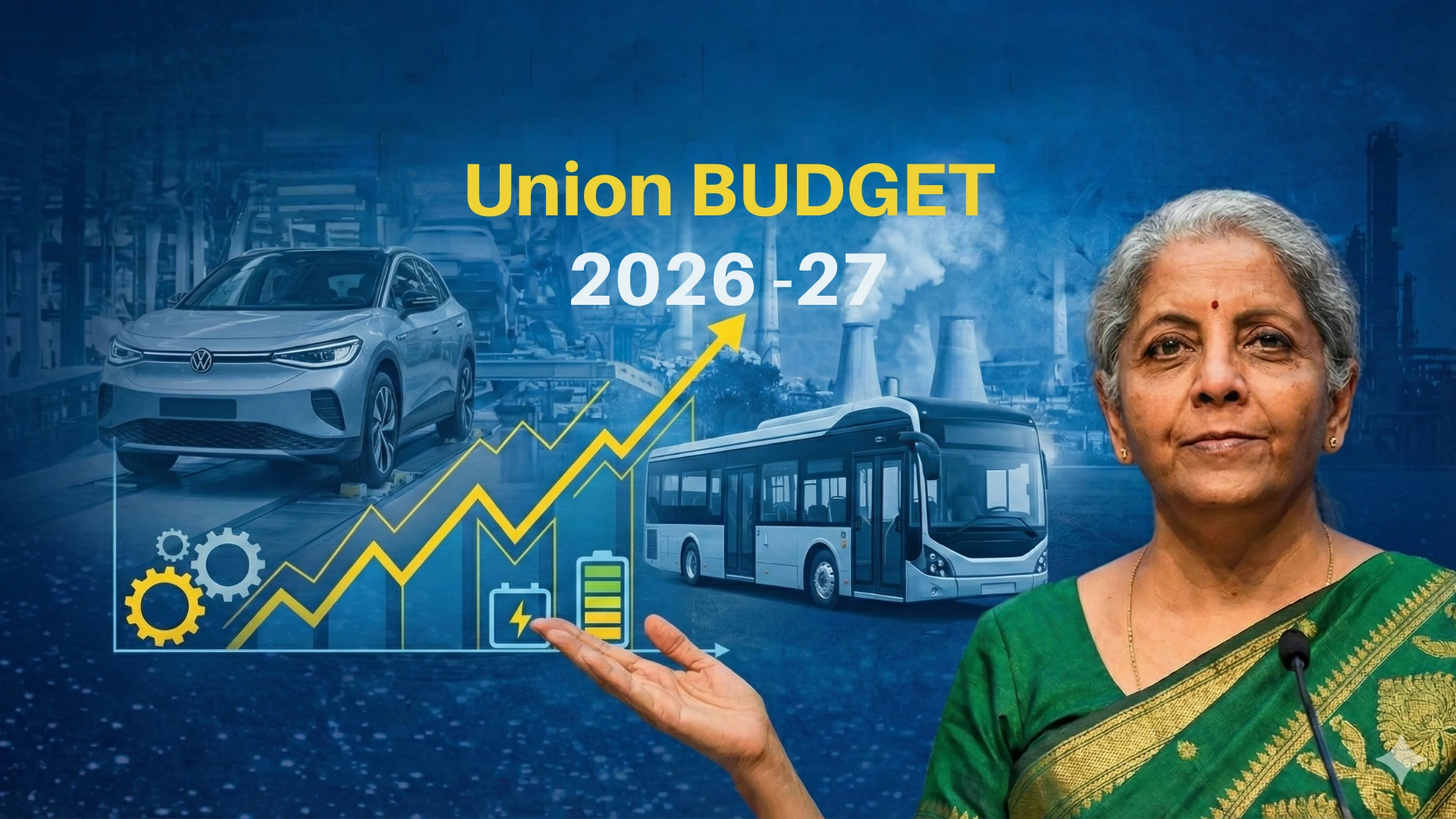

Yesterday, as Finance Minister Nirmala Sitharaman stood up to present the Union Budget 2026-27, the entire automotive fraternity—from the CEOs in boardrooms to the mechanics in local garages—held its collective breath. We weren't just looking for tax cuts; we were looking for a direction.

While you might not see an immediate slash in the sticker price of your favorite petrol hatchback tomorrow morning, the long-term impact of this budget is massive. It’s a clear, decisive push towards a future that is electric, localized, and sustainable.

If you missed the fine print amidst the jargon of "fiscal deficits" and "capex," don’t worry. We have decoded exactly what Budget 2026 means for the cars you drive, the fuel you fill, and the industry we love.

The Big Picture: Green Mobility & Local Tech

The overarching theme for the auto sector this year is unmistakably "Self-Reliance" and "Sustainability." The government has moved beyond just subsidizing the sale of EVs (like the old FAME schemes) and is now laser-focused on subsidizing the making of EVs.

By targeting the supply chain—batteries, minerals, and semiconductors—the budget aims to fix the root cause of high car prices: expensive imported components.

Here is a deep dive into the 7 key updates that will reshape the Indian roads.

1. EVs to Get Cheaper (Eventually!)

The biggest headline is the Extension of Duty Exemptions on capital goods used for manufacturing lithium-ion cells.

- What this means: Until now, a significant chunk of the machinery needed to make EV batteries was taxed heavily when imported. By adding 35 new capital goods to the exemption list, the cost of setting up battery factories in India goes down.

- The Impact: Batteries make up nearly 40% of an EV's cost. If it becomes cheaper to make batteries in Pune or Tamil Nadu than to import them from China, companies like Tata Motors, Mahindra, and MG will eventually pass those savings on to you.

- Critical Minerals: The customs duty exemption on processing minerals like Lithium and Cobalt is the cherry on top. This ensures that the raw materials for these batteries are also affordable.

2. CNG Owners, Rejoice!

If you drive a CNG car—or are planning to buy one of the new CNG SUVs from Tata or Maruti—this update is for you. The budget has introduced a Full Excise Duty Exemption on the biogas portion of blended CNG.

- The Context: The government is mandating the phased blending of Compressed Bio-Gas (CBG) into standard CNG.

- The Benefit: Since the biogas component is now excise-free, the overall cost of CNG at the pump could stabilize or even dip slightly, making it an even more attractive alternative to petrol and diesel. Plus, it’s significantly greener!

3. Fixing the "Brain" of the Car

Remember the massive waiting periods for cars in 2022-23? That was largely due to a shortage of semiconductors (chips). The India Semiconductor Mission (ISM) 2.0 addresses this head-on.

- The Focus: The mission is shifting focus to the entire ecosystem—manufacturing, equipment, and intellectual property.

- Why it Matters: Modern cars are computers on wheels. A steady, local supply of chips means your future car won't be stuck at the factory for months waiting for a tiny silicon chip. It ensures smoother production lines and faster deliveries.

4. Faster Deliveries via Freight Corridors

You rarely think about how your car gets from the factory to the dealership, but logistics is a huge cost for automakers. The announcement of a new Dedicated Freight Corridor between Dankuni (East) and Surat (West) is a game-changer.

- Decongestion: Moving freight from trucks to trains reduces road congestion.

- Cost Efficiency: Rail transport is cheaper and faster for bulk movement. If logistics costs go down, automakers have more room to price their vehicles competitively.

- Waterways: The development of 20 new national waterways adds another layer of efficiency to the supply chain.

5. A Human Touch: Relief for Accident Victims

In a move that shows the government’s humane side, a significant change has been made regarding Motor Accident Claims.

- The Change: Any interest awarded by the Motor Accident Claims Tribunal (MACT) to an individual is now fully exempt from income tax.

- TDS Abolished: Previously, if a victim received compensation with interest due to legal delays, that interest was taxed. Now, the Tax Deducted at Source (TDS) on this interest has been abolished.

- The Impact: This ensures that victims and their families receive the full financial support they deserve without the taxman taking a cut. It’s a small policy tweak with a massive emotional impact.

6. Boosting the Little Guys (SMEs)

A car is made of thousands of parts—nuts, bolts, clips, and gears—mostly made by Small and Medium Enterprises (SMEs). The proposal for a Rs 10,000 Crore SME Growth Fund is vital.

This fund will help these smaller suppliers upgrade their machinery and technology. Better quality parts from suppliers mean better quality cars for us, with fewer rattles and failures down the road.

Budget 2026: At a Glance

|

Announcement |

Impact on Industry |

Impact on You (Buyer) |

|

EV Battery Machinery Duty Cut |

Lower production costs for batteries. |

Cheaper EVs in the next 12-18 months. |

|

Excise Relief on Biogas-CNG |

Promotes green fuel blending. |

CNG prices to remain competitive/lower. |

|

Semiconductor Mission 2.0 |

Stable supply of chips. |

Lower waiting periods for high-tech cars. |

|

Freight Corridor (East-West) |

Cheaper, faster logistics. |

Faster delivery of new cars to dealerships. |

|

Accident Claim Tax Relief |

No tax on compensation interest. |

Full financial support during tragedies. |

So, What Should You Do?

- If you are planning to buy an EV:

Go ahead! While immediate price drops won't happen overnight, the ecosystem is stronger than ever. The support for charging infrastructure mentioned in the budget ensures that owning an EV will only get easier.

- If you are a CNG user:

Stick to your choice. The push for biogas blending not only keeps costs in check but also lowers your carbon footprint significantly.

- If you are waiting for a price cut on Petrol/Diesel cars:

This budget doesn't offer direct tax cuts (like GST reduction) for internal combustion engine (ICE) vehicles. The prices for standard petrol/diesel cars are likely to remain stable.

Final Thoughts

Budget 2026-27 isn't flashy. It doesn't promise "Cars at Half Price!" But it does something more important: it lays the concrete for a highway that leads to a mature, self-reliant automotive industry.

By fixing the supply chain, supporting small manufacturers, and aggressively pushing for green energy components, the government has made it clear that the future of Indian mobility is Electric and Indian-made.

Neha Mehlawat

Neha Mehlawat is an automotive journalist and industry analyst with 10+ years of experience covering cars, bikes, and mobility trends. She tracks the latest launches, technology upgrades, and policy changes in the auto sector, delivering sharp insights that help readers stay ahead in the fast-evolving world of automobiles.